Montana voters legalized recreational marijuana in November 2020. During the first year of sales, which began on Jan. 1, 2022, state retailers sold an estimated $203 million. The March, Sen. Keith Regier, R-Kalispell, introduced a bill to harm the adult-use cannabis industry in Montana.

Senate Bill 546 contains several amendments to the current regulations that would significantly change the state’s marijuana marketplace. The focus of this bill is “eliminating adult-use dispensaries.” This bill has several ways of working towards Regier’s goal.

Firstly, a section of this bill focuses on taxation. This bill would raise the state tax on medical marijuana from 4% to 20%. Secondly, the bill limits medical marijuana potency and allowable amounts for possession. This bill also prohibits non-medical marijuana sales and does not re-criminalize marijuana possession for adults. Thirdly, the bill aims to cut the number of plants an adult can grow at home from two mature plants to one. According to the bill text, SB 546 intends, in part, to “reduce the demand for marijuana sales” in Montana. Unfortunately for Regier, the bill currently does not have any co-sponsors.

The tax revenue since January 2022 has generated $54 million dollars for Montana. If it moves forward, this bill will decrease a large revenue source for the state and its residents. Less than one-tenth came from the $54 million dollar revenue from medical marijuana taxes. Recreational marijuana customers pay a 20% tax to the state; some counties include an additional 3% local tax.

Why You Should Get Your Medical Marijuana Card

Veriheal has satisfied millions of patients nationwide by giving them access to these benefits

- Larger purchase limits

- Peace of mind

- Enhanced legal protection

- Access to higher potency strains

- Save up to 25% on cannabis purchases

- Skip the line at the dispensary

Regier’s Track Record on Hot Button Topics

Marijuana is not the only controversial topic that Sen. Regier has put bills forward towards. He also filed a joint resolution to push Congress to investigate “alternatives” to American Indian reservations, stating that reservations have “failed to positively enhance the lives and well-being of most of the Indians or the other citizens of the State of Montana.” Regier also sponsored Senate Bill 154.

This bill states, “A right to privacy should not apply to an abortion any more than a right to privacy applying to child abuse or abusing a spouse,” he said. “Those acts include another person.” Lastly, Senate Bill 99, a bill that would ban gender-affirming procedures for transgender youth. SB 99 would ban hormone treatments or surgeries for someone under 18 seeking to medically transition to a gender identity different from the sex they were assigned at birth. It would threaten healthcare providers who provide those treatments with a yearlong suspension of their authority to practice and potential legal liability for up to 25 years.

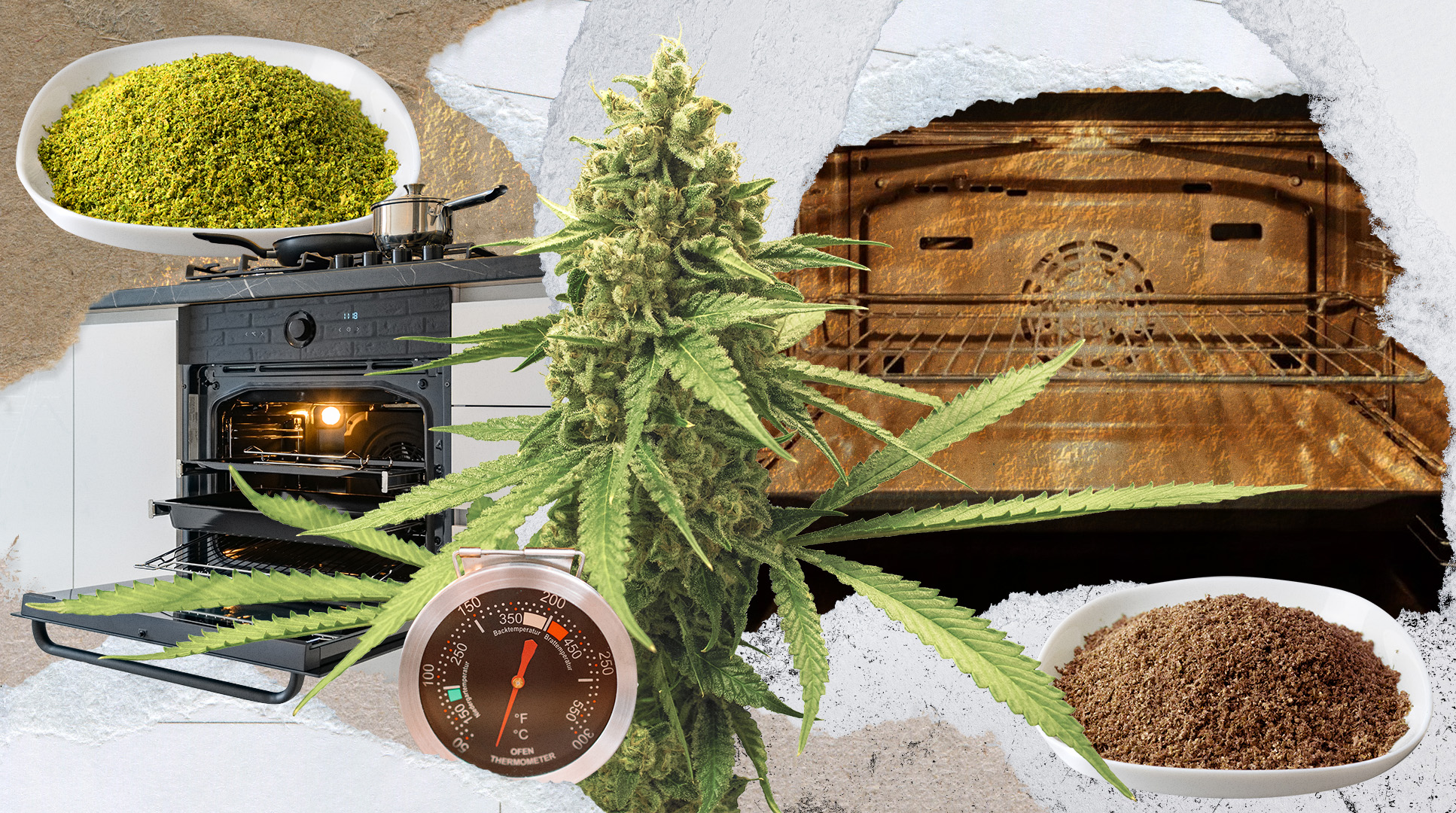

National Taxation Rates

Each state sets its own tax rate because it is still federally illegal. It is up to each state to set its own tax rate. There are several different methods by that each state will set the rate. Taxes can be applied to retail sales, state, local, potency, and weight-based taxes. The most common taxation is through retail tax. This tax does not apply to wholesalers, just the final stop of the marijuana product. Potency-based taxes are designed to disincentivize consumers from buying higher-potency products, but they could also incentivize consumers to buy potent products from the illicit market.

MJBizDaily reported that in 2022, California collected the most state cannabis tax revenue at $744.4 million, or $20 per capita. Cannabis taxes accounted for 0.3% of total state tax revenue (excluding local taxes). Washington State and Colorado had the highest per capita taxes for the fiscal year 2022, at $67 and $61, respectively. Maine had the lowest per capita total for state cannabis taxes, at just $13 per capita.

Regarding how much taxes can affect the end cost for customers, the wholesale cost of an ounce in Colorado is about $44, and in Nevada, it is about $130. Colorado and Nevada tax at the state level for a percentage of the overall price, weight-based tax, and local sales tax. While both states apply the same taxes, the amount of tax and end cost is very different.

Author, Share & Comments