With 19 states currently selling recreational cannabis, it may be tempting to forgo a medical card, even if you qualify as a patient. While recreational marijuana is accessible in many states for those of age, there are still some benefits to having a medical marijuana card and purchasing medical marijuana instead of recreational pot. For example, some states allow medical patients to purchase higher potency products and allow higher possession limits for medical users.

Just like most everything else, cannabis is subject to taxes. If you’re shopping for cannabis at a dispensary and see another person buying the same product for a lower price, you may wonder, is medical and recreational weed the same? In the United States, each state is responsible for how it levies taxes on goods that move within its jurisdictions. Since legalization, cannabis is no different! The way states levy taxes is completely individual to each state. So, the tax rates will vary drastically across the country.

- Overview: What You Need to Know About Marijuana Taxes

- Taxes Medical Marijuana Patients Pay

- Which States Tax Medical Marijuana

- Taxes Recreational Marijuana Users Pay

- How to Save Money Buying Medical Marijuana

- Key Takeaways

Overview: What You Need to Know About Marijuana Taxes

Since marijuana is still federally illegal, there’s no blanket rulings around medical marijuana taxes. However, states and local jurisdictions are free to tax the green at whatever level they deem appropriate. In fact, tax revenue is often an argument pro-pot lobbyists use when trying to get marijuana on the ballot.

There are three main taxes that are imposed on marijuana:

- Excise tax

- Sales tax

- Local tax

An excise tax is imposed on specific goods like tobacco, beer or—in this case—marijuana. Excise taxes are sometimes called “sin taxes,” because they are additional taxes paid on top of local and sales taxes. For other goods, manufacturers sometimes pay the excise tax, but for marijuana, most states pass the excise tax on to the consumer.

Sales tax is a common line on most receipts (unless you’re in Alaska, Delaware, Montana, New Hampshire or Oregon) and is paid to states for all retail goods and services. Marijuana sales are no exception.

Local taxes are special taxes imposed by counties or municipalities to fund specific programs. Alaska, California, Massachusetts, New York, Oregon, and Virginia allow localities to levy an additional tax on marijuana purchases. For example, in California some marijuana purchases are subject to excise taxes, sales tax and local business taxes ranging between 1%-15%.

Taxes Medical Marijuana Patients Pay

While the tax man is involved in medical marijuana purchases, these taxes are often more forgiving than their recreational counterparts; meaning that depending on your state, medical weed may be cheaper than recreational without being any less effective. The following states impose taxes paid by the consumer on medical marijuana:

Which States Tax Medical Marijuana

- Arizona: Purchases are subject to a state excise tax of 6.6% as well as an optional tax set by local municipalities of 2-3%.

- Arkansas: Purchases are subject to the 6.5% statewide sales tax and an additional privilege tax of 4%, as well as all applicable local taxes.

- California: Medical marijuana purchases are not subjected to sales tax, but are subject to a 15% cannabis excise tax as well as local taxes, where applicable.

- Colorado: Sales are subject to a 2.9% state excise tax and any additional local taxes.

- Connecticut: Purchases are only subject to the statewide retail sales tax of 6.35%.

- Florida: Purchases are subject to the statewide retail sales tax of 6%.

- Hawaii: Purchases are subject to the statewide retail sales tax of 4%, except on Oahu where the tax rate is 4.5%.

- Illinois: Purchases are subject only to the 1% statewide sales tax on qualifying drugs. Sellers and cultivators also must pay a 7% tax.

- Iowa: Purchases are subject to the statewide retail sales tax of 6% and any additional local taxes.

- Maine: Purchases are subject to a 5.5% statewide sales tax. Edibles are the exception though, which are taxed at 8%.

- Michigan: Purchases are subject only to the statewide 6% sales tax.

- Missouri: Purchases are subject to a 4% tax.

- Montana: Purchases are subject to a 4% excise tax.

- Nevada: Purchases are subject only to the 4.6% statewide sales tax.

- New Jersey: New Jersey currently taxes medical marijuana at 2%, but is in the process of slowly lowering taxes until they reach 0% on July 1, 2022.

- New York: Purchases are subject to a 7% medical marijuana excise tax, but are not subject to any statewide retail sales tax.

- North Dakota: Purchases are subject to North Dakota’s 5% statewide sales tax.

- Ohio: Purchasers pay statewide sales tax, which varies between 6.5% and 7.25% by county.

- Oklahoma: Purchases are subject to a statewide sales tax of 4.5%, any applicable local municipal taxes and a medical marijuana excise tax of 7%.

- Rhode Island: Purchases are subject only to the 7% statewide sales tax.

- Washington, D.C.: Purchases are subject to a sales tax of 5.75%.

The following states do not tax medical marijuana at all:

- Alaska

- Delaware

- Louisiana

- Maryland

- Massachusetts

- Minnesota

- New Hampshire

- Oregon

- Pennsylvania

- Utah

- Vermont

- Washington

You can check with the department of revenue in your area for more details.

Taxes Recreational Marijuana Users Pay

While some states are forgiving of medical marijuana sales, subjecting them to just sales taxes or no taxes at all, most states ramp the taxes majorly up for recreational marijuana sales. For example, in Oregon where there is no statewide sales tax, recreational marijuana sales are hit with a 17% cannabis excise tax, as well as an additional 3% local municipal tax. By comparison, Oregon medical marijuana patients pay absolutely nothing in taxes.

California medical marijuana patients pay a flat 15% excise tax and some local taxes where applicable, but when it comes to recreational marijuana, the state is looking to generate some revenue. California adult-use marijuana is subject to the 15% cannabis excise tax, as well as a state retail sales tax of 7.25% and an automatic local sales tax of up to 1%. Local municipalities can also impose taxes of up to an additional 15%, meaning recreational sales in California can be taxed as high as 38%. That’s a massive difference from the 15%-20% medical patients are paying in the Golden State, which may be a reason to get your medical card even in a state with legal recreational marijuana.

For a side-by-side comparison of medical marijuana taxes, recreational marijuana taxes, and mmj patient counts by state, check out the table below.

| State |

Medical Tax Rate |

Recreational Tax Rate |

MMJ Patient Count |

| Alaska |

0% |

3-5% excise tax in some municipalities |

391 |

| Arizona |

6.6% state excise tax (2-3% additional taxes in some municipalities) |

21.6% (5.6% sales tax + 16% excise tax) |

307,975 |

| Arkansas |

10.5% (6.5% sales tax + 4% privilege tax) |

N/A |

76,779 |

| California |

15% excise tax + municipal taxes |

23.25% and up (15% excise tax + 7.25% sales tax + 1% local tax, before additional municipal taxes up to an additional 15%) |

1,920,294 |

| Colorado |

2.9% excise tax |

15% excise tax |

87,216 |

| Connecticut |

6.35% sales tax |

N/A |

54,000 |

| Delaware |

0% |

N/A |

15,495 |

| Florida |

6% sales tax |

N/A |

561,177 |

| Hawaii |

4% sales tax |

N/A |

32,801 |

| Illinois |

1% statewide sales tax on qualifying drugs. |

6.25% sales tax + up to 25% based on THC content |

156,224 |

| Iowa |

6% sales tax |

N/A |

Not Available |

| Louisiana |

0% |

N/A |

4,350 |

| Maine |

5.5% sales tax (edibles are taxed at 8%) |

15.5% (10% excise tax + 5.5% sales tax) |

65,368 |

| Maryland |

0% |

N/A |

102,459 |

| Massachusetts |

0% |

17% (10.75% excise tax + 7.25% sales tax) + municipal taxes up to 3% |

69,008 |

| Michigan |

6% sales tax |

16% (10% excise + 6% sales tax) |

250,805 |

| Minnesota |

0% |

N/A |

34,453 |

| Missouri |

4% tax |

N/A |

136,000 |

| Montana |

4% excise tax |

20% excise tax (proposed) |

40,972 |

| Nevada |

4.6% sales tax |

14.6% (10% excise + 4.6% sales tax) |

13,862 |

| New Hampshire |

0% |

N/A |

9,940 |

| New Jersey |

2% (0% after July 2022) |

6.625% sales tax (proposed) |

104,523 |

| New Mexico |

Dispensaries are required to pay a gross receipts tax, which varies across the state from 5.125% to 8.8125%, some retailers may choose to pass this on to patients |

N/A |

112,183 |

| New York |

7% excise tax |

Taxes for purchasing recreational marijuana have not been finalized |

151,355 |

| North Dakota |

5% sales tax |

N/A |

5,392 |

| Ohio |

6.5%-7.25% sales tax depending on the county |

N/A |

186,590 |

| Oklahoma |

11.5% (7% excise + 4.5% sales tax) |

|

368,218 |

| Oregon |

0% |

20% (17% excise + 3% local tax) |

22,566 |

| Pennsylvania |

0% |

N/A |

343,634 |

| Rhode Island |

7% sales tax |

N/A |

19,401 |

| South Dakota |

0% |

19.5% (proposed) |

Not Available |

| Utah |

0% |

N/A |

23,089 |

| Vermont |

0% |

20% (14% excise + 6% sales tax) |

5,209 |

| Virginia |

0% |

26.3% (proposed) |

Not Available |

| Washington |

0% |

37% excise tax |

52,479 |

| Washington, D.C. |

5.75% sales tax |

Adult use sales not legal (adult use consumption is legal) |

9,276 |

| West Virginia |

0% (dispensaries pay 10% on gross receipts) |

N/A |

Not Available |

How to Save Money Buying Medical Marijuana

There are so many benefits to consuming marijuana, but it can be pricey depending on where you live. If you’re looking to reap the rewards of cannabis, which can include greater relaxation, lessened anxiety and pain management, there are a few ways you can keep it from breaking the bank.

Become a Medical Marijuana Patient

As we’ve seen, the price difference between medical and recreational cannabis can be huge. Depending on your state, you may qualify to become a medical marijuana patient. While finding a doctor to help you find relief used to be an ordeal of sketchy office visits and word-of-mouth, Veriheal helps you find licensed providers in your state who can talk about how marijuana can help your symptoms, as well as helping you with the appropriate paperwork. Learn more about how Veriheal can help you become a medical patient.

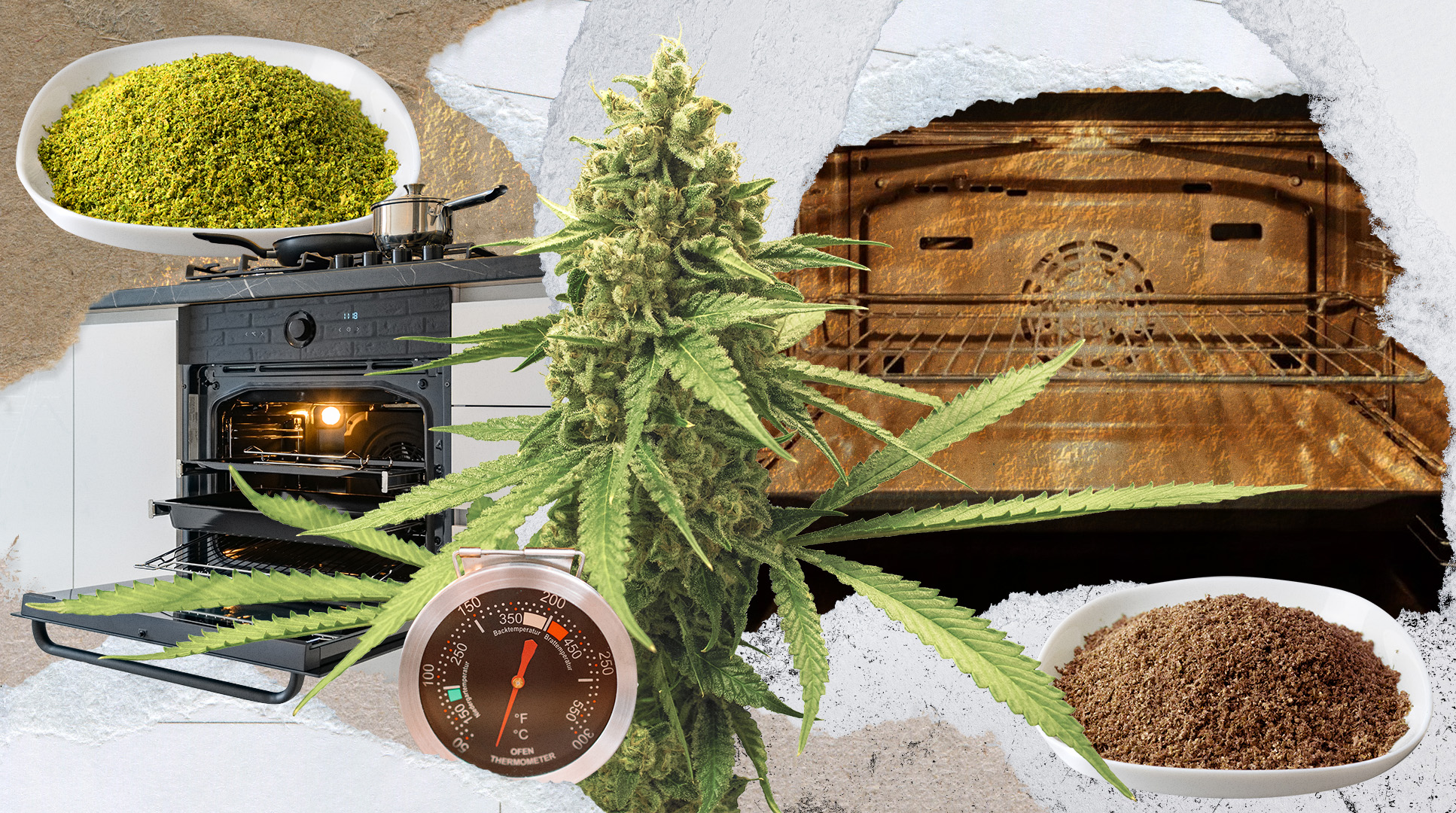

Grow Your Own Cannabis

Growing marijuana for personal use can be an option for those who want to keep up-front costs down, but who have the time and resources to devote to cultivating a rather finicky plant. If you consume cannabis regularly, becoming an at-home grower can allow you to create more variety, save you money and enjoy an engaging hobby. In some states, mmj card holders are allowed to grow more plants than recreational users.

Key Takeaways

While taxes on all marijuana vary widely from state to state, in states where both recreational and medical cannabis is legal, medical marijuana is almost universally going to cost less due to lower taxes. If you want to pursue cannabis therapy or want to become a medical patient, contact Veriheal. We’ll show you the way and help you begin your journey.

Author, Share & Comments